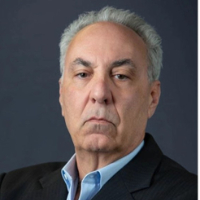

Duane E. Waters | Attorney

Top Local Lawyers

Premium

Premium

Douglas Duran Shaffer

Law Office of Douglas Shaffer

Accident & Injury, Employment, Lawsuit & Dispute, Bad Faith Insurance,

1299 Ocean Ave #900

Santa Monica, CA 90401

Premium

Premium

Jeffrey Lee Zindler Costell

Costell & Cornelius

General Practice, Business, Bankruptcy & Debt, Real Estate,

1299 Ocean Ave Ste 450

Santa Monica, CA 90401

Premium

Premium

Ronald Masaru Takehara

Takehara & Stuart Llp

Business, Accident & Injury, Lawsuit & Dispute, Entertainment, Corporate

100 Wilshire Blvd Suite 700

Santa Monica, CA 90401

Premium

Premium

Sherwin Arzani

Citywide Law Group

Accident & Injury, Animal Bite, Car Accident, Personal Injury, Wrongful Death

12424 Wilshire Blvd Suite 705

Los Angeles, CA 90025

Premium

Premium

Solis Cooperson

Law Offices of Solis Cooperson

Wills & Probate, Estate, Trusts, Tax,

12400 Wilshire Blvd Suite 990

Los Angeles, CA 90025

Premium

Premium

J. Jeffrey Morris

Law Office of J. Jeffrey Morris

Criminal,

11845 West Olympic Boulevard Suite 1000

Los Angeles, CA 90064

Premium

Premium

James Selth

Weintraub Zolkin Talerico & Liu LLP

Bankruptcy & Debt,

11766 Wilshire Boulevard Suite 730

Los Angeles, CA 90025

Premium

Premium

Daniel Weintraub

Weintraub Zolkin Talerico & Liu LLP

Bankruptcy & Debt,

11766 Wilshire Boulevard Suite 730

Los Angeles, CA 90025

Premium

Premium

Catherine Liu

Weintraub Zolkin Talerico & Liu LLP

Bankruptcy & Debt,

11766 Wilshire Boulevard Suite 730

Los Angeles, CA 90025

About Duane

Duane E. Waters is Of Counsel to Gilchrist & Rutter. Mr. Waters's practice focuses on federal and state income taxation research and planning, estate and family planning, IRS audit representation and appeal, and tax impacts of business and transactional planning.

A Certified Public Accountant, Mr. Waters acquired his expertise in real estate and partnerships during a long career with Arthur Andersen LLP. He successfully founded and managed the firm's practice in Hawaii, building it into the largest accounting firm in the state, while simultaneously managing the Los Angeles office. Mr. Waters retired from Arthur Andersen as Tax Partner in 2000.

Mr. Waters's clients have included Maguire Properties, LP; Thomas Properties Group, Inc.; Catellus Development Corporation; CommonWealth Partners, LLC; The Shidler Group; and Playa Vista.

Mr. Waters speaks frequently before industry professionals and related business organizations on real estate taxation, partnership taxation, family tax planning and other tax issues, including the impact and consequences of planning on federal and state income taxes. A widely-published contributor to various trade journals and business publications, Mr. Waters also wrote Cost Allocations for Real Estate Developers and co-authored Federal Taxes Affecting Real Estate.

Mr. Waters received his J.D. degree from the University of Southern California School of Law, Los Angeles, where he also graduated with a B.S. in accounting.

Representative Experience:

Counsel a broad base of clients, including large publicly-held corporations, entrepreneurs, non-profit organizations, large foundations and wealthy individuals, with specific emphasis on federal and state tax implications, tax deferments and tax credit transfers.

Provide clients with in-depth analysis regarding the relevance and importance of tax law changes, court decisions, revenue rulings and administrative actions. Counsel clients int he structuring and protection of their assets and income with respect to such new legislation and court rulings.

Counsel clients in the formation of partnerships, trusts, family limited partnerships, professional corporations and related entities, and employee stock ownership plans (ESOPs). Counsel real estate investment trusts (REITs) in business transactions and tax requirements.

Thirty-year practice as a Certified Public Accountant with the accounting firm of Arthur Andersen LLP, from 1970 until retirement from that firm as a Tax Partner in 2000.

As Tax Partner at Arthur Andersen, directed firm-wide real estate tax practice, including partnership specialty teams. Founded Arthur Andersen's Hawaii tax practice, building it into the state's largest accounting practice within only a short period of time. Simultaneously managed dual full-tax practices in both Hawaii and Los Angeles. Engagement Partner on two of the largest real estate clients of Arthur Andersen. Taught and wrote training materials for firm programs.

Education

USC Law School

J.D.

Gilchrist & Rutter Highlights

Land Use & Zoning, Environmental Law, International, Business, Real Estate, Litigation