Torrance Estate Lawyers, California

Torrance Estate Lawyers, California

Sponsored Law Firm

-

x

x

Click For More Info:

-

Law Office of Timothy J. Doherty

10 Crater Lake Ave Medford, OR 97504» view mapEstate Law Experience You Can Trust

The topic of wills and trusts can be confusing, but my job is to help you decide what’s right for you. Call me to set up a free consultation.

800-878-0640

Sponsored Lawyers

1-10 of 66 matches

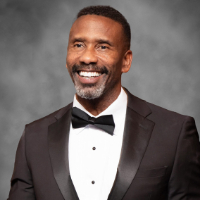

Divorce & Family Law, Estate, Lawsuit & Dispute, Real Estate, Business

Attorney Wade specializes in civil litigation, conducting jury trials in complex cases and in helping individuals and businesses in every phase of their development. He has been practicing law for almost twenty years. He also has served as both a judge pro tem and an arbitrator for the Santa Clara County Superior Court, and has guest lectured at Stanford University.

(more)Divorce & Family Law, Estate, Divorce

Jennie LaRossa graduated from Loyola Marymount University with a B.A. in psychology and obtained her Juris Doctor from Western State University College of Law. Jennie is known for her compassion, success, and for being a strong advocate for her family law clients. She is also an experience mediator and minor’s counsel. Jennie takes great pride in assisting her clients through the legal process and is able to settle most of her cases our of court. This helps families by avoiding unnecessary litigation, expense, and emotional trauma — especially when children are involved. Mrs. LaRossa is a member of the State Bar of California, Long Beach Bar Association, and is a past president of the Long Beach Barristers Association. Mrs. LaRossa is also a past member of the Joseph A. Ball / Clarence S. Hunt Inns of Court and attended the American Inns of Court Celebration of Excellence Awards Banquet at the United States Supreme Court.

(more)Estate, Bankruptcy & Debt

Kahlil McAlpin is a lawyer serving Playa Del Rey in Chapter 7 Bankruptcy and Bankruptcy & Debt cases. McAlpin Law Realty 8616

(more)

Timothy J. Doherty Medford, OR

Timothy J. Doherty Medford, OR Practice AreasExpertise

Practice AreasExpertise