Los Angeles Estate Lawyers, California

Los Angeles Estate Lawyers, California

Sponsored Law Firm

-

x

x

Click For More Info:

-

Rosenberg Mendlin & Rosen, LLP

528 Colorado Ave Santa Monica, CA 90401» view mapEstate A California law firm focusing on litigation

We represent clients in a number of litigation settings.

800-887-8721

Sponsored Lawyers

1-10 of 75 matches

Accident & Injury, Real Estate, Employment, Business, Estate

Alex Mehdipour attended the University of California San Diego where he received his degree in political science. After graduating from UCSD, Mr. Mehdipour attended Southwestern University School of Law where he received his JD. Upon passing the bar, Mr. Mehdipour gained invaluable experience both in a law firm and business setting. Mr. Mehdipour uses his prior business and legal experiences to negotiate the most advantageous results for his clients.

(more)Business, Real Estate, Estate, Landlord-Tenant

With an office located in Beverly Hills, I proudly serve the local residents in all Business and Real Estate Matters.

(more)Estate, Tax

John R. Ronge, Attorney at Law has been providing quality, personalized legal and professional guidance to individuals, estates, trusts and businesses for over 25 years. The firm's expertise ranges from income, income tax and accounting, to more in-depth services such as probate estate and planning.

(more)Estate, Bankruptcy & Debt

Kahlil McAlpin is a lawyer serving Playa Del Rey in Chapter 7 Bankruptcy and Bankruptcy & Debt cases. McAlpin Law Realty 8616

(more)Wills & Probate, Trusts, Lawsuit & Dispute, Estate Administration, Real Estate

California attorney Scott Rahn resolves contests, disputes and litigation related to trusts, estates and conservatorships, creating a welcome peace of mind for clients. He represents heirs, beneficiaries, trustees and executors. He utilizes his experience to develop and implement strategies that swiftly and efficiently address the financial issues, fiduciary duties and emotional complexities underlying trust contests, estates conflicts and probate litigation. Driven by a commitment to provide relief to people grieving the loss of a loved one, Scott collaborates closely with clients. He pursues and defends claims involving incapacity, incompetence, undue influence, breach of fiduciary duty, and other similar areas of dispute. His advice and counsel includes prevention and remediation of financial elder abuse.

(more)Wills & Probate, Estate, Trusts, Tax

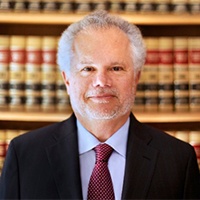

We specialize in: Probate, Wills and Estate Planning, Estate Litigation and special issues regarding Testamentary Competence and Elder Abuse.

(more)Wills & Probate, Immigration, Visa, Family Law, Adoption

The Law office of Jennifer Lim located in in Los Angeles County, California, with practice areas in Immigration & Naturalization Law, Family Law, Wills & Probate and Business Litigation. The principal of the law firm, Jennifer S.F. Lim, has been practicing immigration law, family law and probate law for many years. Our firm objective is to provide first-rate, professional service to all our clients on a timely basis. Towards this objective, we participate in continuing legal education and keep abreast of new laws and developments, utilize high tech solutions and programs, and maintain a multi-lingual support staff. To achieve the desired results for our clients, we keep abreast of the latest legal trends, provide diligent advocacy of their legal claims, monitor their cases with attention to fine detail, provide interpreters and translation services, and use a wide network of information resources. In the field of family law, we handle adoptions, guardianships, divorce, support and custody matters in California courts. In probate court, we have represented clients in decedents' estate, conservatorships and other probate law matters. Our reasonable fee structure and timely handling of critical issues have earned the trust and confidence of our clients. Our approach focuses on achieving client objectives with effective and cost-efficient strategies, avoiding high conflict and emotionally costly outcomes whenever possible. With extensive courtroom and trial experience, we handle legal matters through settlement or judgment.

(more)Estate

Attorney Lisa MacCarley is well-versed in all aspects of the California probate code: probate, guardianships, conservatorships and estate planning. She also has extensive experience working with clients through the elder law issues they or their loved ones face, and is talented at mediation in the face of conflict. Lisa attended Loyola Law School and was admitted to practice law in California in 1993. A former New York state resident, she attended State University of New York College (SUNY), Cortland. After visiting Los Angeles to thaw out after four long years in the arctic tundra of upstate New York, Lisa fell in love with the City of Angels and has lived here ever since. Lisa MacCarley worked as a law clerk in 1990, and by 1997 had established her practice in Glendale as an estate and probate lawyer. Lisa planned on working in the area of elder law, conservatorships, and probate from the day she started law school. She correctly anticipated that there would be a growing need for legal services by and for our aging population in California. After more than 25 years of helping individuals and families throughout Southern California, Lisa is very experienced with dealing with the challenges of aging, adult incompetency, and loss.

(more)Estate, Trusts, Wills & Probate

I grew up in Napa, California and retain strong family ties there. I raised my family in Southern California and as a result I am now a Southern California Transplant. I graduated from Occidental College in 1993 with a degree in Politics and gained sales and management experience for four years prior to enrolling in Loyola Law School of Los Angeles in 1997. I earned my Juris Doctorate from Loyola in 2001 and graduated in the top 10% of my division. I have been a civil litigator my entire career, conducting over 2000 bench trials and more than 350 of these in probate court alone. I have been victorious in well over 95% of these trials, recovering hundreds of millions of dollars for my clients. As I move to my mid 50’s, my children are pretty much all grown, my life is stable, and I am focused on providing excellent, high quality, and focused attention to individualized cases where I believe I can truly make a difference. I want to get to know my clients and I want them to get to know me.

(more)Divorce & Family Law, Estate, Lawsuit & Dispute, Real Estate, Business

Attorney Wade specializes in civil litigation, conducting jury trials in complex cases and in helping individuals and businesses in every phase of their development. He has been practicing law for almost twenty years. He also has served as both a judge pro tem and an arbitrator for the Santa Clara County Superior Court, and has guest lectured at Stanford University.

(more)

Roger Rosen Santa Monica, CA

Roger Rosen Santa Monica, CA AboutRosenberg Mendlin & Rosen, LLP

AboutRosenberg Mendlin & Rosen, LLP Practice AreasExpertise

Practice AreasExpertise